Since its last rebound, bitcoin has been in a consolidation phase for the past two weeks. Find Elyfe's analysis to decipher the technical perspectives of BTC.

Finance News

The global economy wavers between uncertainties and successive crises, and some analysts predict an even darker future. Among them is Robert Kiyosaki, entrepreneur and author of the bestseller "Rich Dad Poor Dad," who issues multiple warnings. He claims that a major economic collapse looms on the horizon, driven by a housing market crash, rampant inflation, and mass unemployment. More than just a prediction, his message is a call to action: those who do not prepare risk seeing their wealth collapse. But for Kiyosaki, solutions do exist, and among them, one currency seems truly capable of withstanding the financial chaos: Bitcoin.

France votes on a budget, the French express distrust: 80% predict collapse, 61% no longer even hope for themselves.

While the Fed hesitates between caution and action, inflation runs rampant, and crypto wavers, poised for a week of financial roller coasters.

Elon Musk's DOGE is literally about to "break down" the doors of the SEC in his quest to eliminate unnecessary government spending. This new step in Musk's crusade for government efficiency could transform financial regulation in the United States. An initiative sprinkled with a hint of personal vengeance?

European economies are facing a worrying reality: a public debt that keeps rising. While budget stability is supposed to be a priority for governments, several countries in the European Union now show debt levels that far exceed 100% of their GDP. This situation raises questions about macroeconomic risks and the potential consequences for financial markets.

The global geopolitical balance is undergoing significant changes. Russia, which was once a member of the G8 before its exclusion in 2014, is now adopting a radically different stance. In the face of what it perceives as a decline in the influence of Western powers, Moscow now favors the BRICS and the G20, at the expense of a G7 deemed obsolete. This strategic reconfiguration goes beyond a mere diplomatic adjustment; it illustrates a broader shift in power dynamics, where emerging economies are gaining ground against Western-dominated institutions. Through the statements of its ambassador to Canada, Russia confirms its definitive disengagement from the G7 and outlines the contours of a new international order.

The Paris Stock Exchange is going through a marked period of hesitation, facing a double challenge: the threats of a trade war from Donald Trump and the geopolitical developments surrounding Ukraine. On Monday, February 17, 2025, the CAC 40 shows a slight decrease of 0.03% at 8,176.47 points, reflecting the investors' caution in the face of these major issues.

France is going through a pivotal period. On one hand, public debt has reached historic highs, exceeding 3 trillion euros. On the other hand, a profound transformation of institutions is disrupting the traditional balance of the Fifth Republic.

The Russian economy is wobbling under the weight of its own structural flaws and an increasingly hostile international environment. While the Kremlin attempts to project resilience in the face of Western sanctions and geopolitical tensions, the latest reports from the Bank of Russia and the Ministry of Economy paint a much more troubling reality. With the collapse of oil revenues, a skyrocketing budget deficit, and a private sector on the brink of asphyxiation, Russia faces major economic challenges that could profoundly affect its stability in the medium term.

Is the value of a property still based solely on its location? While the French market is undergoing its most significant correction in decades, the dynamics of the sector seem to be reversing. After a sharp price drop in 2024, the year 2025 is set to be one of profound transformation for the market. From major metropolitan areas to medium-sized cities, from deserted offices to less accessible housing, a shift is taking place, driven by an unprecedented economic and regulatory context. Amid rising interest rates, tighter credit, and new environmental requirements, real estate must rethink its fundamentals.

The economic divide between the French is widening as wealth concentrates in the hands of a tiny minority. At a time when the debate over tax justice is raging, a recent study by the General Directorate of Public Finances (DGFiP) paints a picture of the 0.1% of the wealthiest French citizens, revealing an increasingly marked fracture with the rest of the population. Who are these 74,500 households that make up this financial elite? What are their incomes, the structure of their wealth, and how has their situation evolved over the past few decades?

The SEC, once inflexible, is making a turn towards crypto: Dogecoin and XRP are entering the fray, and time is working against the regulator, stuck in a tight schedule until October.

Like a cowboy drawing his six-shooter, Trump unleashes reciprocal tariffs, awakening old economic ghosts and sowing panic for Bitcoin in the stock markets.

After reaching a peak of $19.5, the price of Uniswap has fallen, bringing it below $10. Check out Elyfe's analysis and break down the technical outlook for the UNI token.

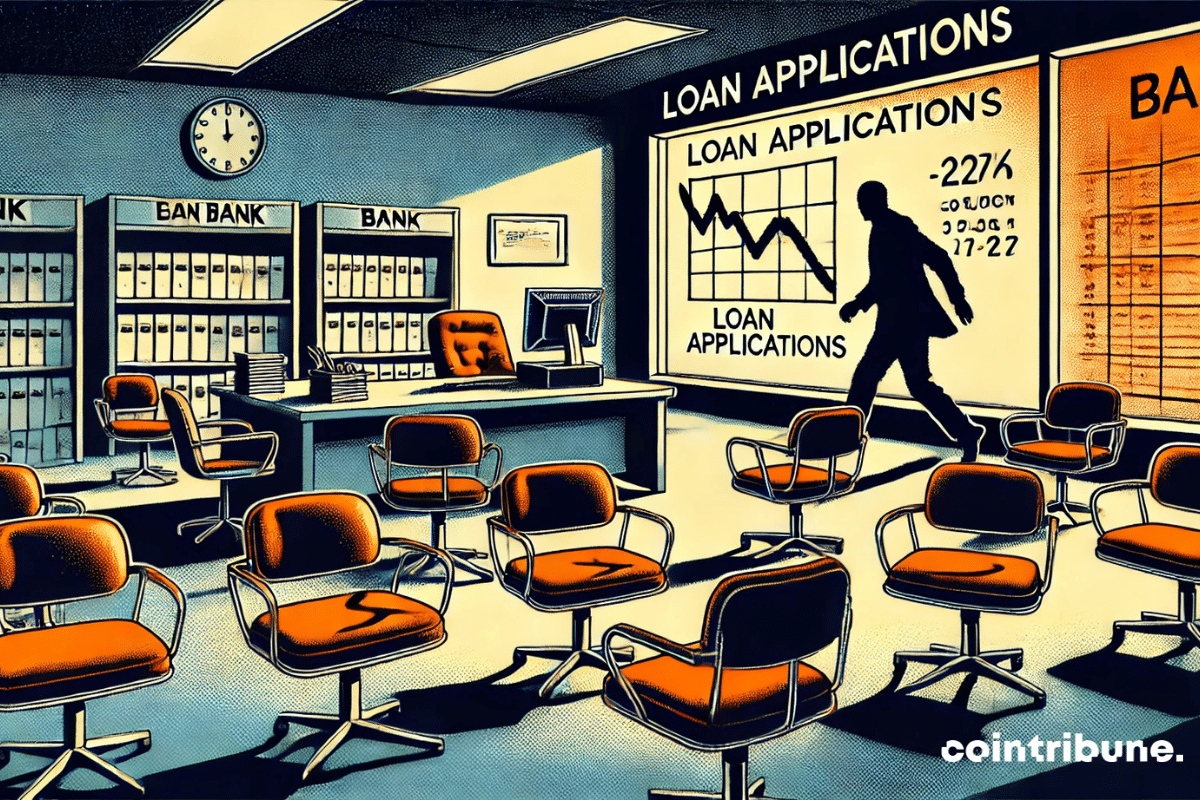

The French are borrowing less and less, an unprecedented trend that raises numerous questions about the country's economic dynamics. For the past six years, the contraction of the credit market reflects both the caution of households and the structural difficulties in real estate and consumption. The rate of credit holdings has fallen to its lowest level in over thirty years, a situation that even exceeds the shockwave caused by the subprime crisis in 2008. However, the first signs of a rebound in 2025 are emerging, fueled by a gradual improvement in households' financial situations.

Solana Down -40% Since Its Last ATH, What Levels To Watch? Technical Analysis From February 12, 2024

After reaching its highest historical level, Solana is facing bearish pressure threatening its price. Discover Elyfe's analysis to decipher the technical outlook for SOL.

The BRICS continue to redefine the global geopolitical landscape. As the group expands and seeks to strengthen its influence, its relations with the West become strained. The latest episode: Iran, a new member of the bloc, has categorically rejected any negotiation with the United States. "Negotiating with America does not solve any of our problems," Tehran stated. This is a firm refusal of any diplomatic opening with Washington. This positioning, much more than a simple political statement, illustrates a growing rift between the BRICS and Western powers.

The foreign exchange market is abuzz. While the American Federal Reserve maintains a cautious stance on interest rates, the dollar is sinking against major currencies. In a context of economic uncertainty, between rising inflation and trade tensions exacerbated by Donald Trump, investors and analysts are closely monitoring every statement from the Fed chair, Jerome Powell. His testimony before the Senate confirmed that the monetary institution would not hasten interest rate cuts, despite market expectations. Meanwhile, the announcement of new protectionist measures by the U.S. executive fuels fears of a tightening global economic climate.

After falling to $91,350, Bitcoin has attracted buyer interest, maintaining its price. Check out Elyfe's analysis to decipher BTC's technical outlook.

Currency symbols are not just simple coins; they embody eras, values, and habits rooted in a country's culture. However, in the United States, the existence of the penny is once again being questioned. Donald Trump, in search of budgetary rationalization, wishes to eliminate this one-cent coin, which he considers a waste of resources. This decision, far from being trivial, sparks a fundamental debate between economic necessity and attachment to American numismatic heritage. If enacted, the measure could disrupt commercial habits and provoke adjustments in the daily lives of Americans.

Amid revolutionary announcements, technological evolutions, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic disputes. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Donald Trump's crypto program could have significant repercussions on the acceleration of the development of the digital euro, according to Piero Cipollone, a member of the European Central Bank (ECB). He expresses hope that the European Parliament and the Council will finalize discussions on the legislation governing the digital euro by the summer of 2025.

The fusion of technology and power is an equation that Elon Musk seems to have made his playground. From controlling Twitter (now X) to space initiatives with SpaceX, the billionaire has made numerous incursions into spheres traditionally reserved for states. His latest initiative, targeting the U.S. Treasury's payment system, has not succeeded this time. What was supposed to be a transparency operation regarding the management of financial flows has turned into an unprecedented legal confrontation, questioning the legality of such control. In light of the controversy and the risks of disclosing sensitive information, the judiciary has ruled and imposed an immediate ban on Musk and his collaborators.

The social network X, formerly Twitter, is once again under judicial investigation in France. On January 12, Deputy Eric Bothorel alerted the Paris prosecutor's office about the algorithms of Elon Musk's platform, suspected of manipulation. This investigation follows several ongoing legal actions against the platform.

Rumors about a common BRICS currency frequently resurface, fueling speculation about a possible counterweight to the dollar. As several nations seek to reduce their dependence on the greenback, the prospect of a shared currency raises concerns in the United States. Donald Trump has threatened to impose sanctions on countries considering an alternative. However, the Kremlin has just defused the debate: no such project is under discussion. Instead, the bloc prioritizes joint investment platforms, leaving doubt about its true monetary strategy.

Ethereum continues to face downward pressure, pushing its price lower. Let's analyze the future prospects of ETH.

Sino-American relations continue to deteriorate, pushing China to strengthen its ties with the European Union. Lin Jian, spokesperson for the Chinese Ministry of Foreign Affairs, stated that Beijing sees Europe as a "global strategic partner and an important and independent pillar in a multipolar world."

Traditional finance and bitcoin are continuing to draw closer. Following the resounding success of its Bitcoin ETF IBIT in the United States, BlackRock, the world's largest asset manager, is preparing to take a new step: the launch of a Bitcoin Exchange Traded Product (ETP) in Europe. This fund, which will be domiciled in Switzerland, reflects the growing desire of financial institutions to establish a lasting presence in the crypto market. While the United States has seen Bitcoin ETFs capture more than $57 billion in assets in just a few months, this new product could change the European landscape. Why Switzerland rather than another country? What will be the effects on investors and the institutional adoption of bitcoin in Europe? These are all questions that arise as BlackRock accelerates its international offensive.

Shares of gold mining companies surged on Wednesday, February 5th, on Wall Street, driven by a new historic record of gold at $2,869.68 per ounce. This spectacular increase comes amid a revived trade war between Washington and Beijing, prompting investors towards safe-haven assets.