The dominance of Bitcoin (BTC) in the crypto ecosystem has recently reached a yearly high, piquing the curiosity of investors and experts. Why this sudden resurgence? And what are the implications for altcoins?

Theme Bitcoin (BTC)

Things are looking up for the American miner Core Scientific, which has been on the brink of bankruptcy for a year.

In a 1.5-hour interview, Michael Saylor revealed the catalysts for the next Bitcoin bull run.

Bitcoin is poised to deliver a performance that could leave the audience in awe. In these times of economic turbulence, the star of Bitcoin shines with a newfound brilliance, promising a golden dawn that would surprise even the most optimistic among us. Behind the scenes of this grand stage are significant movements, signaling an unexpected and historic surge.

The world of crypto is catching its breath: Bitcoin (BTC) has surged to $27,400, marking a 10% increase over the past week. Additionally, the open interest on BTC also saw a 10% rise in just 3 hours yesterday. However, this situation is evoking familiar sentiments among investors, reminiscent of the temporary surge on August 29th, following Grayscale's victory over the SEC. Are we witnessing a similar scenario?

The Terra storm heavily impacted the Bitcoin price and several crypto projects, including Celsius Network. In July 2022, the crypto lender formerly led by Alex Mashinsky declared bankruptcy, with a balance sheet burdened by over $4.7 billion in debt to its users. However, the Celsius team remained resilient during these challenging times. Recently, the bankruptcy court gave the green light for the execution of the financial restructuring plan for this crypto company. To top it off, Celsius acquired a Bitcoin mining site in Texas.

In a world where bitcoin fever continues to gain momentum, a new chapter looks set to open, promising far-reaching upheavals in the global financial landscape. A veritable tidal wave seems to be in the making, orchestrated by asset management titans who control colossal fortunes. These giants, armed with their trillions, are ready to invest massively in bitcoin. Such an incursion could well redefine the financial paradigms we know today. But what if a significant fraction of this financial windfall were to make its way into the crypto market?

James Howells is a Bitcoin investor who misguidedly misplaced £164 million by throwing a hard drive into a landfill. To this day, he hopes to recover his Bitcoin (BTC) holdings despite a decade-long legal battle.

While the United States, through the SEC and CFTC, grapples with regulatory challenges in the cryptocurrency market, Germany is forging ahead. Currently, numerous German banks have already stepped into the exciting world of cryptocurrencies, and some local financial institutions believe it's time to embark on this adventure. This includes the Stuttgart Stock Exchange, which plans to launch crypto staking next year.

The co-founder of the payment company Lightspark, focused on the Bitcoin Lightning Network, has recently spoken about the archaic state of the international payment system. On September 12, 2023, during an appearance on CNBC, David Marcus discussed the potential of the Bitcoin network and expressed his commitment to turning it into a global payment system.

Renowned for being tamper-proof and completely transparent, Bitcoin is often touted as a perfect 'trustless' network. But can we truly say that we trust no one but ourselves when we use Bitcoin? This is the question posed by Pierre Schweitzer during the Surfin Bitcoin 2023 event in Biarritz.

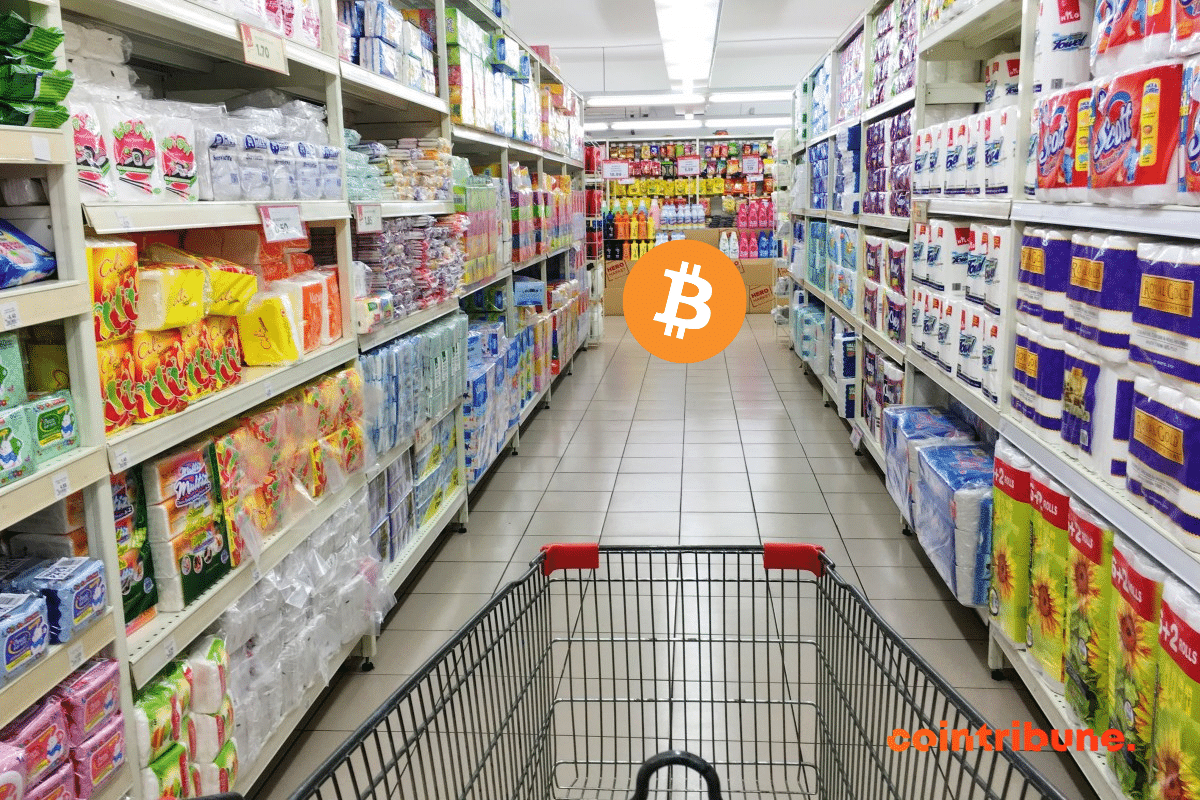

What is the cumulative inflation since 2010? What is the extent of purchasing power loss?

Will the ECB stop raising its key interest rate soon? Some governors hope so.

All eyes are on bitcoin (BTC). Prices are not showing positive signs, and investors are becoming increasingly concerned. But while some are desperately hoping for a rise, their wish is unlikely to come true. According to Jamie Coutts, the downtrend has not said its last word.

The Emir of Qatar, Sheikh Tamim bin Hamad Al Thani, is set to step foot in El Salvador during an official visit scheduled for this week. As El Salvador recently made headlines by adopting Bitcoin, this diplomatic initiative piques curiosity. Could Qatar be considering a similar adoption?

Bitcoin dropped by around -3% on Monday, September 11. Let's take a look at the prospects for the $BTC price.

India announces 5 revolutionary measures for the crypto sector at the G20

This week, the crypto market has experienced notable turbulence, orchestrated mainly by bitcoin. A shadow of decline now looms, leading to a widespread and immediate plunge in altcoins.

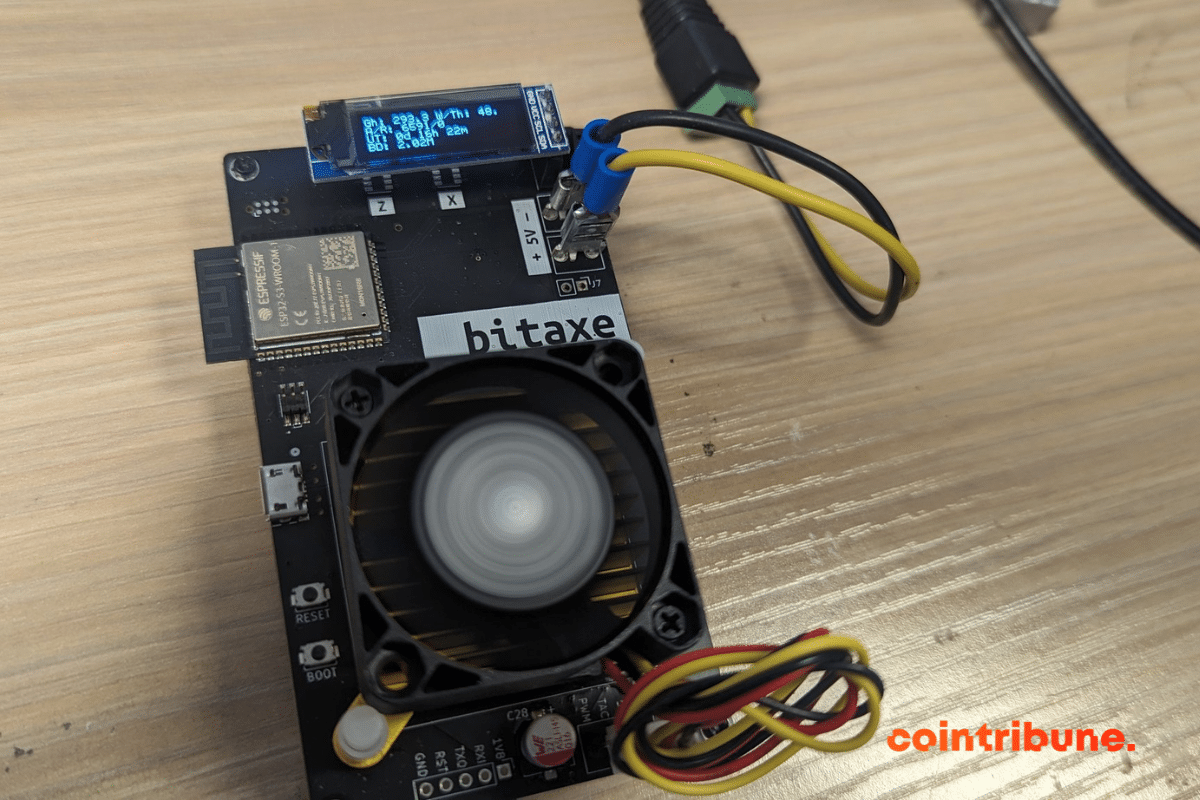

Is the decentralization of the Bitcoin network about to improve thanks to minimalist miners such as Nerdminer and Bitaxe?

In the vast crypto universe, every week brings its share of revelations and surprises. As enthusiasts and investors alike scrutinize the evolution of Bitcoin, the crypto giant has a week full of developments in store for us. Without further ado, let's dive into the fascinating world of Bitcoin, exploring the five major alerts that are on everyone's lips.

In the crypto world, a revolutionary dynamic is underway. Recent figures confirm this unequivocally: Tron, Bitcoin, and BNBChain are currently the titans of the sector.

There will be some rumblings in the crypto industry in the next few days. Because if approved, FTX will liquidate a large number of its digital assets. There's talk of a plan to sell $200 million in cryptocurrencies. Something to keep an eye on!

Renowned investor Warren Buffett doesn't like cryptocurrencies, bitcoin (BTC) included. And he's not hiding it. On several occasions, the billionaire has explained why, in his opinion, this asset is not worth investing your money in. Yet there is evidence that the businessman has missed an opportunity to increase his fortune.

The crypto industry has been rocked by news of Bitcoin ETFs, a financial product that could revolutionize the way institutional investors interact with Bitcoin. Gracy Chen, CEO of Bitget, offers her perspective on the subject in this exclusive interview.

The first domino of the bull run has fallen. U.S. companies will soon be able to account for their Bitcoin holdings at their fair value.

The financial sector in the United States is anticipating a significant revision in the accounting of cryptocurrencies, particularly Bitcoin. This recent decision aims to enhance clarity, accuracy, and confidence in the valuation of digital assets by businesses.

Over the last 8 years, September has been the second-worst month in terms of bitcoin (BTC) performance. On average, bitcoin falls by 5% in September. Conversely, September is often a good opportunity. The end of the year often marks a powerful "Christmas effect", which is usually accompanied by a rise in cryptocurrency. But if studying the past sheds light on probabilities, it's worth looking at the indicators available on the bitcoin price.

For the past few months, Bitcoin ETFs have been among the most closely followed news items on the crypto market. The reason for this is their potential role in the explosion of asset prices, starting with bitcoin. Indeed, the eventual arrival of a Bitcoin ETF on the market is seen as good news. But it seems, according to some experts, that it could thwart the ambitions of crypto exchanges. Here's why.

While many haters see Binance nearing the end, CZ, the exchange's founder, believes they're very much mistaken. For him, nothing is certain, since his company hasn't yet shown everything. Things are about to change in the crypto ecosystem, and the platform won't be left behind.

Considered to be the most important crypto, Bitcoin continues to spread to the four corners of the globe. The adoption of this crypto even extends to the level of institutions and governments, raising questions. What if it were to influence the global financial system?