Cryptos are experiencing marked declines followed by signs of recovery this week, with short-term stabilization forecasts.

Ethereum (ETH)

Whales are massively selling Ethereum, causing downward pressure on the market. Here are the implications for crypto!

The crypto market is witnessing a notable trend: the increasing dominance of Ethereum’s “whales.” These large investors, who now hold 43% of the total supply, have significant influence capable of moving the market. As their grip continues to strengthen, a crucial question arises: what will be the repercussions of this…

Bitcoin ETFs end an 8-day streak of outflows with $28 million in inflows! Ethereum ETFs, on the other hand, continue to struggle.

The Layer 2 blockchain of one of the largest crypto exchange platforms in the world, Coinbase, Base, has just reached a historic milestone by surpassing Ethereum in the number of daily transactions. This remarkable performance propels Base to the rank of uncontested leader in scaling solutions.

Ethereum sets a record with 126,210 new wallets created in one day, signaling a potential rise in crypto.

Amid revolutionary announcements, technological advancements, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic struggles. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Ethereum underperforms by 44% compared to Bitcoin since The Merge! Here are the key factors and future outlook.

The year 2024 promises to be significant for Ethereum, the second-largest crypto in the market. In the midst of a whirlwind, Ethereum reserves on centralized exchange platforms have reached a historically low level, a phenomenon not observed since 2016. This drop in reserves comes as Ethereum price volatility draws considerable…

In crypto, Vitalik Buterin proposes a marriage with Google… and buries the deadly duels with panache.

Decentralized finance (DeFi) is experiencing rapid growth, threatening Ethereum's dominance. Experts predict that the total value locked (TVL) of Bitcoin-based DeFi applications could surpass that of Ether in the next two years.

Bitcoin ETFs recorded outflows of $211.15 million, far more than Ethereum ETFs! What is happening?

Bitcoin and Ethereum options expire on September 6, 2024, with a total value of $1.07 billion!

With 127 million holders, Ethereum far surpasses Bitcoin. We provide you with all the details in this article.

After a significant correction, Ethereum has initiated a rebound, which already seems threatened. Let's take a look at future prospects for ETH.

Ethereum has just experienced its worst month in over two years. In August, ETH fell by 22%, wiping out any hope of a quick recovery. This drop comes at a time when many observers were expecting 2024 to be a positive year for the digital asset, particularly due to the anticipation of new regulations and the approval of an ETF. However, the reality is quite different. Factors such as massive fund outflows from Ethereum ETFs, scathing critiques from its co-creator Vitalik Buterin, and a decline in activity on the main network have plunged the market into a downward spiral.

176 million dollars inflow into digital assets! Revealing significant trends for crypto investors.

Amid revolutionary announcements, technological developments, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic conflicts. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Cryptocurrencies, particularly Bitcoin and Ethereum, have generated increasing interest in recent years, both from the general public and celebrities.

Ethereum ETFs are at risk of disappearing due to their poor performance and low interest from crypto investors.

In 2024, Ethereum is going through a particularly dark period. The third quarter of the year, traditionally bearish, has been marked by a continuous decline in prices, leaving crypto investors perplexed. While Bitcoin has managed to maintain some balance, Ethereum seems to be falling into a negative spiral. What does…

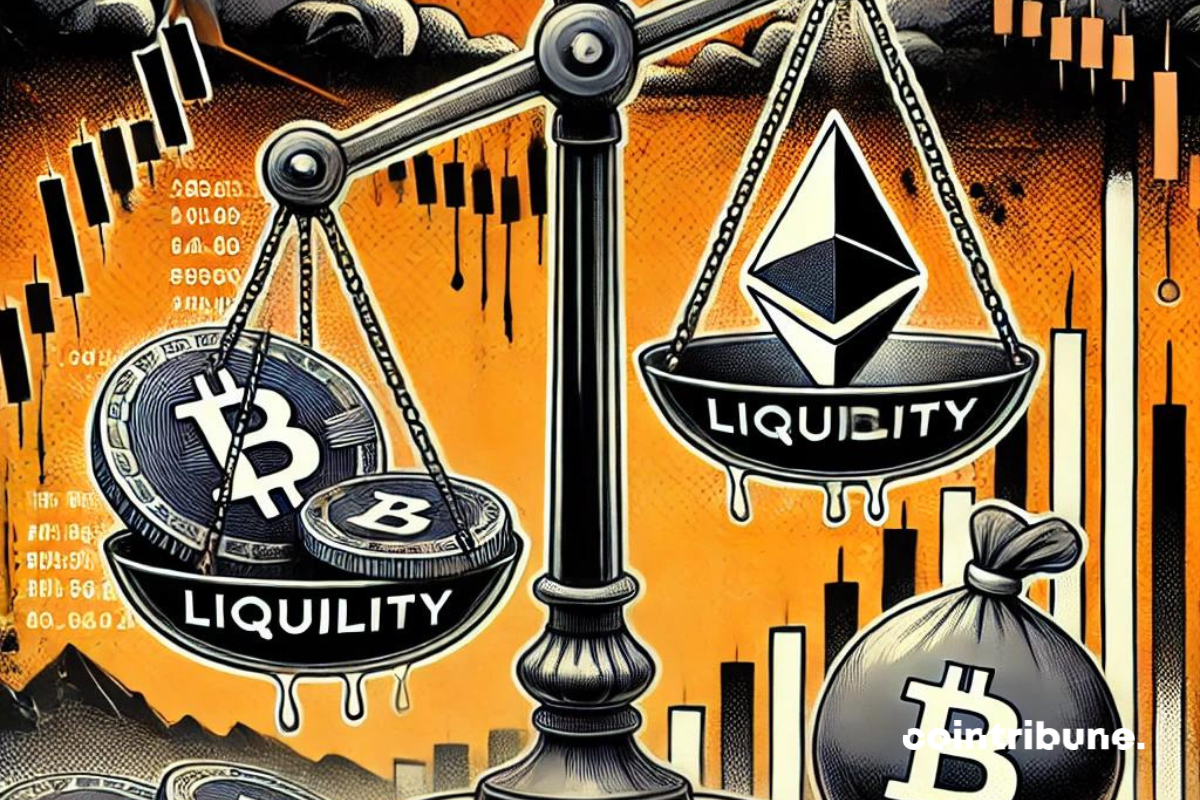

The question of liquidity in the crypto market remains a major challenge. The recent introduction of exchange-traded funds (ETFs) for Bitcoin (BTC) and Ethereum (ETH) in the United States had raised hopes for improvement. However, according to the latest report from Kaiko, these expectations have only been partially met. Despite an increase in trading volumes on major platforms since November 2022, the reality is that the market remains fragile and vulnerable to sharp fluctuations. This report highlights two areas for reflection: the limited impact of ETFs on the true liquidity of the market, and structural issues.

Ethereum, the leading platform for smart contracts, is now established as the preferred playground for a growing army of developers and researchers. With a tremendous increase in the number of its researchers since 2019, this blockchain is positioning itself as a true laboratory of ideas and technologies for the future. How has this dynamic taken hold, and what are its implications for the crypto ecosystem?

Bitcoin and Ethereum ETFs are experiencing record fund outflows, reflecting investor uncertainty!

Crypto: Ether ETFs have lost 500 million in 5 weeks, a striking contrast to the success of Bitcoin ETFs. The details!

When Bitcoin crashes, Markus pipes up on X, offering a lesson in monetary philosophy in 280 characters. Photo Credits: By Mikaïa - Cointribune

Big crash for Bitcoin and Ethereum: 145 million dollars went up in smoke, the crypto market is wavering like never before.

The crypto market has just suffered a major setback with the spectacular drop of Ethereum. Indeed, the second-largest cryptocurrency by market capitalization plummeted by 9% in just 24 hours. This plunge, fueled by massive sell-offs from large holders and ETF investors, intensifies the pressure on an already fragile market. This episode could well alter the perception of Ethereum as a reliable investment asset.

Toncoin and Ether lead the crypto downturn, exacerbated by long liquidations, highlighting the volatility of the cryptocurrency market.

The summer of 2024 marks a significant slowdown for Ethereum, the second-largest cryptocurrency in the world. Recent data reveals a substantial decrease in trading volume and the number of transactions on its network during the month of August.